tax on unrealized gains uk

However it was my understanding that unrealised gains of this nature should be stripped out of the calculation for Corporation Tax. It is a profitable position that has yet to.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US.

. The unrealized capital gains tax came into discussion in 2021 when Joe Biden and the Democrats found a new way to tax billionaires. According to the ATAD Directive the tax levied on unrealized capital gains is intended to ensure that if a taxpayer moves assets or its tax residence out of the tax jurisdiction of a state that state is allowed to tax the economic value of any capital gain created in its territory even though that gain has not yet been realized at the time of the exit. As opposed to a short-term investment a long-term investment is investment for a long period such as a year or longer.

Tax rates increase as a property is sold. Taxes are paid only on realized gains. 30 2021 Published 1040 am.

I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k. Limited company made 100k of investments during its company year - all investments in publicly traded shares not funds or unit trusts they bought shares directly in companies. Unrealised gains on investment shares - is Corp tax chargeable.

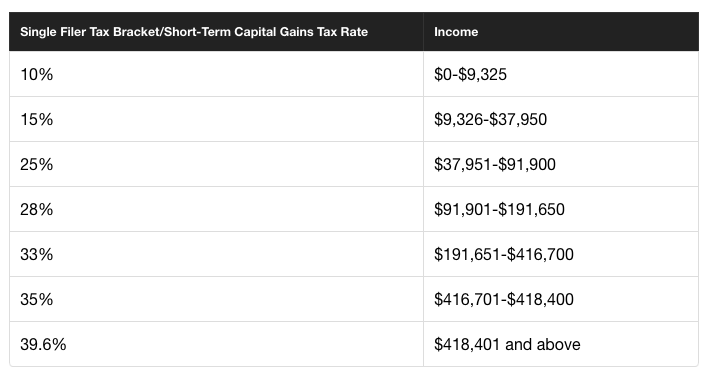

If you were to sell this position youd have a realized gain of 2000 and owe taxes on it. And the value of their unrealized gains differs significantly about 100000 for the bottom 20 versus 17 million for the top 10 on average according to the Federal Reserve. 3 hours agoProfits generated within one year are subject to the 15 percent capital gains tax.

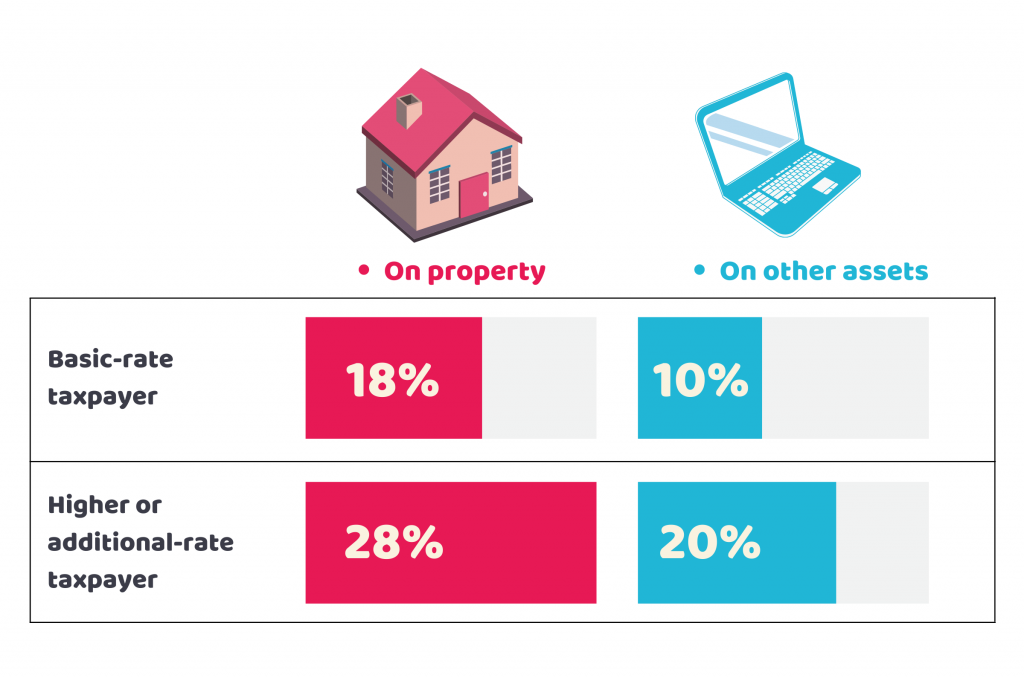

Capital gains are taxed at rates of. However they have to pay 28 CGT on any gains in a property. For example if you were ahead of the curve and bought bitcoin for 100 and now its worth 9100 you have an unrealized gain of 9000.

Households worth more than 100 million as. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. For example if you were ahead of the curve and bought bitcoin for 100 and now its worth 9100 you have an unrealized gain of 9000.

How Would Unrealized Capital Gains Tax Affect You. What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. The investor can plan when to sell the security and realize his gains.

What we need is a tax that focuses on the wealth of the richest Americans But it faces plenty of challenges. Generally unrealized gainslosses do not affect you until you actually sell the security and thus realize the gainloss. Thus by knowing the Unrealized Gain the Company can forecast the amount of tax to be paid if they sell the securities.

You will then be subject to taxation assuming the assets were not in a tax-deferred account. An unrealized gain is a profit that exists on paper resulting from an investment. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

This is true in that case the profits are entirely tax-free. Taxing unrealized capital gains at death theoretically increases the revenue-maximizing. Raising the rate is not going to cause Jeff Bezos to pay a penny more Warren told MSNBC yesterday.

0 for taxable incomes under 40400 for single taxpayers 80800 for married couples filing jointly 15 for taxable incomes between 40400 and 445850. Under FRS102 we need to show the investments at market value at year end which is easy to do as they are publicly. Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American people as they can to fund Joe Bidens tenure-defining 6 trillion spending.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. The purpose of this tax was to help the millions of American who needed financial help. Avoidin g Capital Gains Tax on Property UK.

Realizations would fall so much that it would more than offset the revenue produced by the higher tax rate. Its the gain you make thats taxed not the. The price of BTC has increased by 3000 but you havent sold your asset.

Holding security for a long time may reduce the tax implication as it will be treated as long-term capital gains tax. You have a realized loss of 500. You have an unrealized gain of 3000.

This means that tax liabilities can arise from exchange gains which are unrealised and so are unfunded. A further complexity arises in the UK as tax is calculated on an individual entity basis. This reflects the 10k investment and the 5k unrealised gain.

When a property is sold your taxable gains will exceed 18 of the sale price or 28 when your taxable gains exceed 28. There are some situations where you can avoid capital gains tax on the property in the UK. The High rates and additional rates taxpayers will pay 20 CGT on chargeable assets.

Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run. The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue. And Senator Elizabeth Warren pushed a more sweeping version of an unrealized capital gains tax during her presidential run.

But then there are two groups of people who dislike the idea. You buy 1 ETH for 4000. Do you pay tax on Unrealised gains.

12 minutes agoMarch 26 2022 229 PM PDT. You buy 1 ETH for 4000. Billionaires may be the first target but a successful deployment could see the net widen.

What Is The Capital Gains Tax Rate For 2021 Uk. You later sell your ETH for 3500. You buy 05 Bitcoin for 30000.

In 2021-22 and 2020-21 capital gains tax rates will be revised.

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Enjoy The Etf Tax Dodge While You Can

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

What Is Capital Gains Tax Quora

What Is Capital Gains Tax Quora

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

How To Avoiding Capital Gains Tax On Property Uk Accotax

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Why Don T Rich People In The Uk Pay Much Tax Quora

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

The Overwhelming Case Against Capital Gains Taxation

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)